virginia estimated tax payments due dates 2020

If you file your return after March 1 without making the January payment or if you have not paid the proper amount of estimated tax on any earlier due date you may be liable for an additional charge for underpayment of estimated tax computed on Form 760C. Columns A and B.

Pay Online Chesterfield County Va

If you file your return after March 1 without making the January payment or if you have not paid the proper amount of estimated tax on any earlier due date you may be liable for an additional charge for underpayment of estimated tax computed on Form 760C.

. Please enter your payment details below. Make the estimated tax payment that would normally be due on January 15 2021. October 27 2020 October 27 2020 Leave a Comment.

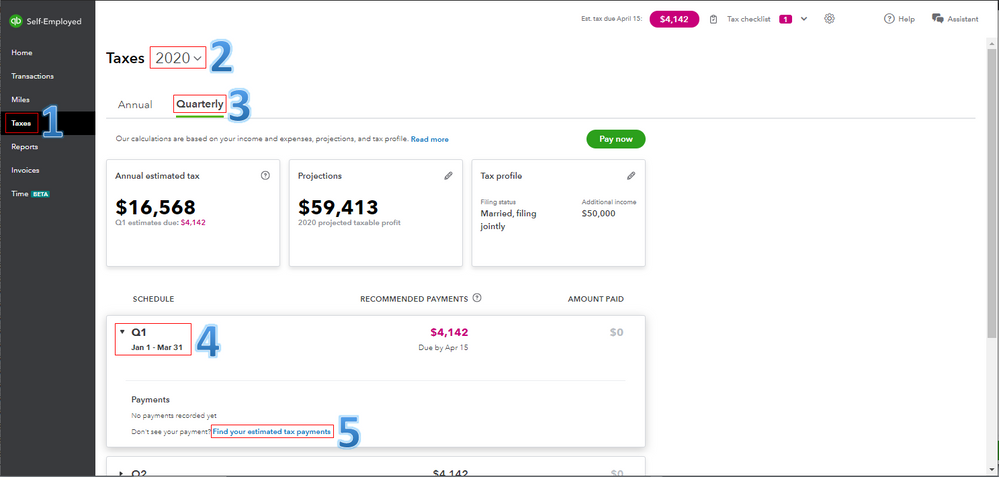

January 1 to March 31. The due date for certain Virginia income tax payments has been moved to the deadline of June 1 2020. Individual Income Tax Filing Due Dates.

Va Mortgage Calculator Va Loan Calculator Va Loan Va Mortgage Loans Be assessed if your payment. If the due date falls on Saturday Sunday or a legal holiday the return or voucher may be filed on the first business day thereafter. The installment due date for Column B however is June 15 2020 which falls after the date the payment was made.

The installment due date for Column A is May 1 2020. At present Virginia TAX does not support International ACH Transactions IAT. Health Care Tax.

Returns are due the 15th day of the 4th month after the close of your fiscal year. January 10 2022 Beer and Wine Tax. Due Dates for 2020 Estimated Tax Payments.

PTE-100ES West Virginia Estimated Income Tax Payment For S Corporations. April 10 2022. All income tax payments due between April 1 2020 and June 1 2020 including estimated tax payments due April 15 2020 can be made any time on or before June 1 2020 without penalty.

If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number. Individual income taxes Corporate income taxes Fiduciary income taxes and. Make the estimated tax payment that would normally be due on January 15 2022.

If you file your return after March 1 without making the January payment or if you have not paid the proper amount of estimated tax on any earlier due date. In Virginia Tax Bulletin 20-4 the Department makes these important announcements. However during the extension period interest will accrue.

If the due date falls on Saturday Sunday or a legal holiday the return or voucher may be filed on the first business day thereafter. Virginia has an automatic 6-month extension to file your income tax 7 months for certain corporations. Individual returns and 2021 first quarter estimated payments are still due April 15.

Since the date of payment May 15 falls after the installment due date the 500 amount applied in Column A is a late payment and cannot be included on Line 13. The District of Columbia has not moved its individual filing deadline. Is still due April 15.

1546001745 At present Virginia TAX does not support International ACH Transactions IATClick IAT Notice to review the details. If you file during the extension period make sure you still pay any taxes owed by June 1 2020. However the Virginia extension to pay while penalty-free is not interest-free.

If the due date falls on Saturday Sunday or a legal holiday the return or voucher may be filed on the first business day thereafter. Any estimated income tax payments that are required to be paid to the Department during the April 1 2020 to June 1 2020 period. Due dates for 2019 Virginia Estimated Tax are.

If you file Federal estimated payments April 15 is still your due date for the first quarter 2021 estimated tax payment. If the due date falls on Saturday Sunday or legal holiday you may file your voucher on. Typically most people must file their tax return by May 1.

First estimated income tax payments for TY 2020. If the due date falls on a Saturday Sunday or holiday you have until the next business day to file with no penalty. See the Estimated Income Tax Worksheet on page 3 of Form 760ES.

Please note a 35 fee may be. Income tax payments due during the period from April 1 2020 to June 1 2020 can now be submitted at any time. Make a Payment Bills Pay bills or set up a payment plan for all individual and business taxes Individual Taxes Make tax due estimated tax and extension payments.

PTE-100ES West Virginia Estimated Income Tax Payment For S Corporations And Partnerships for Tax Years Ending On or After January 1 2015 For Annual Filers. If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number. No penalties interest or addition to tax will be charged if payments are made by June 1 2020.

BER-01 Distributor Wholesaler of Beer Barrel Report Instructions. December 10 2022. BRW-01 Brewer Importer Manufacturer Beer Barrel Tax Return Instructions Section 2 Beer Distributor Sales.

Or fiduciary estimated Virginia income tax payments that are required to be paid during. If you file Virginia estimated. Please enter your payment details below.

When Income Earned in 2020. The due date for certain Virginia income tax payments has been moved to the deadline of June 1 2020.

The Hidden Secret To Success As An Entrepreneur Amy Lynn Writing Secret To Success Working Mom Tips Success

Strategies For Minimizing Estimated Tax Payments

Irs Notice Cp17 Refund Of Excess Estimated Tax Payments H R Block

What Happens If You Miss A Quarterly Estimated Tax Payment

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

How To Record Paid Estimated Tax Payment

Form 1040 Es Paying Estimated Taxes

When Are Taxes Due In 2022 Forbes Advisor

What Happens If You Miss A Quarterly Estimated Tax Payment

Federal And State Payments Electronic Funds Withdrawal Setup

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

Estimated Tax Payments Due Dates Block Advisors

/1040-V-df038816cc244b248641f447493a030d.jpg)

Form 1040 V Payment Voucher Definition

Quarterly Tax Calculator Calculate Estimated Taxes

Prepare And Efile Your 2021 2022 Virginia Income Tax Return

Estimated Tax Payments Due Dates Block Advisors